Call Us: +617 5631 9862 Email: enquiry@taylorhay.com.au Request Enquiry

Call Us: +617 5631 9862 Email: enquiry@taylorhay.com.au Request Enquiry

An effective fraud risk identification process includes an assessment of the incentives, pressures, and opportunities to commit fraud. Employee incentive programs and the metrics on which they are based can provide a map to where fraud is most likely to occur.

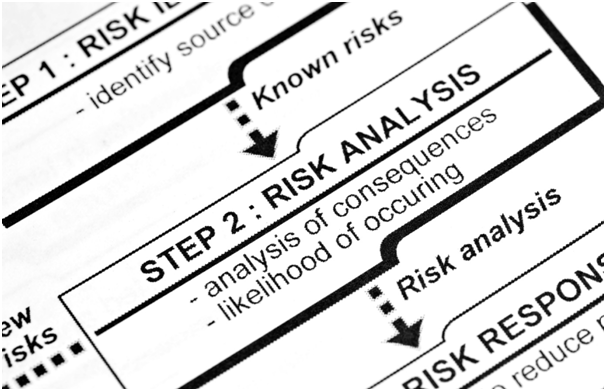

A fraud risk assessment is different to an audit in that it is a detailed and focused examination to identify any opportunities available to an employee to commit fraud. Our approach has been developed to fill the gap left by internal and external Auditors who are primarily looking at controls.

At TaylorHay we look at how a fraud may occur, what could contribute to it and how to remedy the situation. A TaylorHay fraud risk assessment not only examines existing controls, but also focuses specifically on control measures aimed at detecting and/or preventing fraud. Our assessments examine whether or not controls can be evaded and consider the vulnerability of controls to management override.

It is a powerful assessment that identifies exactly where the fraud risks within your organisation are.

Our fraud risk assessments concentrate on fraud related activities that can:

FRAUD OPPORTUNITIES |

||

| TYPES OF FRAUD | CHARACTERISTICS OF FRAUD OPPORTUNITIES WITHIN BUSINESS PROCESSES | EXAMPLES OF PROCESSES OR PROCESS ELEMENTS |

| Financial Fraud |

|

|

| Theft of Assets |

|

|

| Theft of Services |

|

|

| Misrepresentations |

|

|

For further information relating to our specialist services please contact us or call on +617 5631 9862.